“No matter what happens to any of us, the synagogue is a constant.”

“No matter what happens to any of us, the synagogue is a constant.”

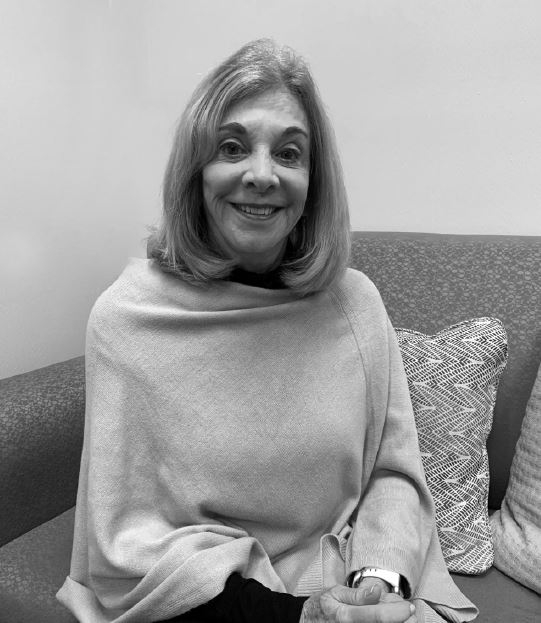

Shai Kartus has always had a special relationship to her Judaism and her synagogue, Congregation Agudath Israel in Caldwell. “I was always more connected than almost any of my peers,” she said. “I always loved going to my synagogue. When my mom became president, it was a really big deal for my family. I was super inspired.” Shai, now 26, became president of her USY chapter, where she met her best friends and her first boyfriend. “It gave me my own experience of leadership apart from my parents and jumpstarted my passion for being involved in the Jewish community.”

At Binghamton University, Shai got involved with Jewish community service projects on campus through Hillel and Chabad. And when she graduated, she chose to make Jewish communal work her profession—she started her first job, at UJA-Federation of New York, the day after graduation. And on her first day at work, she did something that surprised everyone, even her parents.

“She came home from work and said, ‘I want to leave a legacy gift to Agudath Israel. I can put them as beneficiary on my insurance policy,’” Shai’s mother Esther Kartus reported. “She had all the paperwork. My husband and I were blown away.” Agudath Israel is one of 23 local organizations participating in Greater MetroWest’s Create a Jewish Legacy program, a community-wide partnership that helps Jewish organizations approach their donors for legacy gifts in order to ensure that their valuable work can continue far into the future.

“I hadn’t thought about speaking to Shai or my sons about a legacy gift yet—it wouldn’t have occurred to me,” Esther added. She and her husband had made their own legacy gift to Agudath Israel from their IRAs and are planning to add an additional legacy when they redo their wills.

Jewish communal involvement is Shai’s family legacy—and Esther’s as well. “Growing up, I can’t remember a time my mother wasn’t at the shul, cooking,” Esther recalled. Her mother was a past president of her synagogue’s Sisterhood and an incredible role model for volunteering, as were all of Esther’s aunts, who lived in the same town and participated in activities like cooking for seniors in the local nursing home.

When Esther married and moved to Caldwell, it was natural for her to start volunteering. And the fact that the Kartuses found Congregation Agudath Israel so warm and welcoming made it easy for them to feel a part of the community. Twenty-eight years later, after raising three children there, Esther said she still feels the same—and hears that sentiment from newcomers and long-time members alike.

All three Kartus children went through nursery school and Hebrew school at Agudath Israel. “I grew up knowing this was important,” Shai said. “I knew about Legacy Circle because my mom helped to start it after her term as president. I knew the ins and outs of what it meant to leave a legacy gift. So that’s why it struck me right away.”

The Agudath Israel development director helped Shai accomplish her goal of creating a legacy through her life insurance policy. For Shai’s parents, it was an incredible moment. “You want to be a role model for your children, want them to be connected to Jewish community, and you hope they’re paying attention.”

Shai still works at UJA, where she oversees a variety of leadership development and content programs, including a Third-Generation Holocaust Survivors & Supporters group. She hasn’t changed her mind and her passion hasn’t diminished. In fact, she’s working on sharing her enthusiasm with others. “I hope it inspires other people,” she said.

She has taken part in Congregation Agudath Israel’s organized Legacy Shabbats, with hopes to present the Create a Jewish Legacy program to her peers. “It’s a philanthropic opportunity anyone can participate in, a fundraiser everyone can be involved in, because you don’t have to give money now, you can leave a legacy gift,” Shai said. “Through a legacy gift, members who might only be able to give a small amount each year can give back to the community they love so much, in a more meaningful, lasting way.

“The synagogue is the place where I was always most comfortable and always felt at home—my favorite place to be. I want to make sure that people can always feel that way at Agudath because it’s always meant so much to me. No matter what happens to any of us, the synagogue is a constant, and it’s up to our community to make sure it stays that way for generations to come.”

Jewish Responsibility, and Keeping an Eye on the Future

Jewish Responsibility, and Keeping an Eye on the Future

At Large

At Large President

President